Main Street Lending Program Expanded to Nonprofit Organizations

Fed announces that smaller nonprofit organizations can now apply for the Main Street Lending Program

Date: July 19, 2020

Author: Dot Org Web Works

As Bloomberg and Los Angeles Times have also recently reported, the Federal Reserve has formally extended its Main Street Lending Program to smaller nonprofit organizations.

“Nonprofits provide vital services across the country and employ millions of Americans,” Federal Reserve Chair Jerome H. Powell said. “We have listened carefully and adapted our approach so that we can best support them in carrying out their vital mission during this extraordinary time.”

Based on public feedback to proposals released for comment on June 15, 2020 the minimum employment threshold for nonprofits was lowered from 50 employees to 10, the limit on donation-based funding was eased, and several financial eligibility criteria were adjusted to accommodate a wider range of nonprofit operating models. Additionally, like the proposed terms, each organization must be a tax-exempt organization as described in section 501(c)(3) or 501(c)(19) of the Internal Revenue Code.

The reduction from 50 to 10 employees makes it possible for a substantial greater number of nonprofits to get the emergency funding relief they need. Smaller nonprofits, which tend to be more flexible and have been on the front-line of the COVID-19 pandemic, have borne the brunt of cuts in traditional giving since so much of their revenue depends on the public which are now economizing more than ever. This news could not come at a better time.

Since COVID-19 has created a global recession (some will argue depression), having access to emergency funding like any other business simply makes good economic sense since nonprofits are doing the work of many while employing millions.

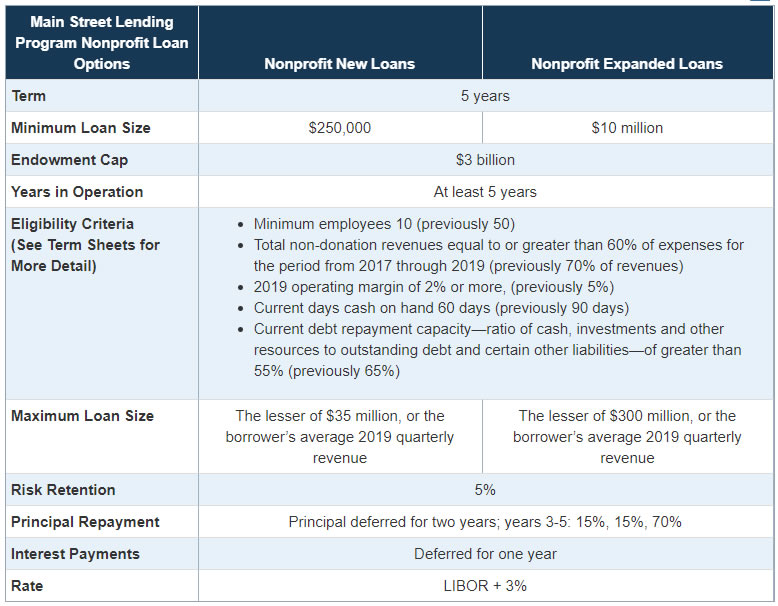

The Main Street nonprofit loan terms generally mirror those for Main Street for-profit business loans, including the interest rate, principal and interest payment deferral, five-year term, and minimum and maximum loan sizes. Nonprofits will be eligible for two loan options, and the chart below has additional details on the final terms.

Who to Contact

For general inquiries regarding the Main Street Lending Program please email: mslp@bos.frb.org.

Patricia Prudente on Unsplash.com

Patricia Prudente on Unsplash.com